Automated data collection from banks and payment systems

Importing data from banks and payment systems saves time on manual data entry and reduces the likelihood of errors.

Financial

Accounting

Solution

Fin Lime

is a modern solution for managing your company's finances. Automated data collection from banks and payment systems, work with cryptocurrencies, simple and intuitive interface, scalability and flexibility, the ability to configure detailed access rights, a wide range of functions, high performance, use of double entry entries, work in the cloud and high reliability - all this makes our product indispensable for the successful financial accounting of your company.

Advantages

Automated data collection from banks and payment systems

Importing data from banks and payment systems saves time on manual data entry and reduces the likelihood of errors.

Ease of use

intuitive minimalistic interface makes working with the product pleasant and easy, focusing your attention while working with the product

Flexibility

customisation according to your company's needs, use only those features that will make your work with the product even more efficient.

High productivity

Ensures fast and accurate operations, reducing the time spent on financial management

Cloud Operation

Working in the cloud allows you to keep track of your finances anytime, anywhere in the world.

Work with cryptocurrencies

allows you to keep track of transactions with digital assets, monitor cryptocurrency exchange rates and receive real-time reports.

Scalability

Easily scalable, allowing users to expand their business without limitations

Wide range of features

Includes many features such as expense accounting, revenue recognition, bank account management, report generation and more

Use of double entry posting

Based on a double entry posting system, allows for more accurate recording of financial transactions, minimising errors and increasing data reliability

Reliability and security

allows you to be confident that your data is secure by providing access according to detailed customisable roles to different employees

Integrations

The number of integrations and processed statements expands with user needs

Generated statements

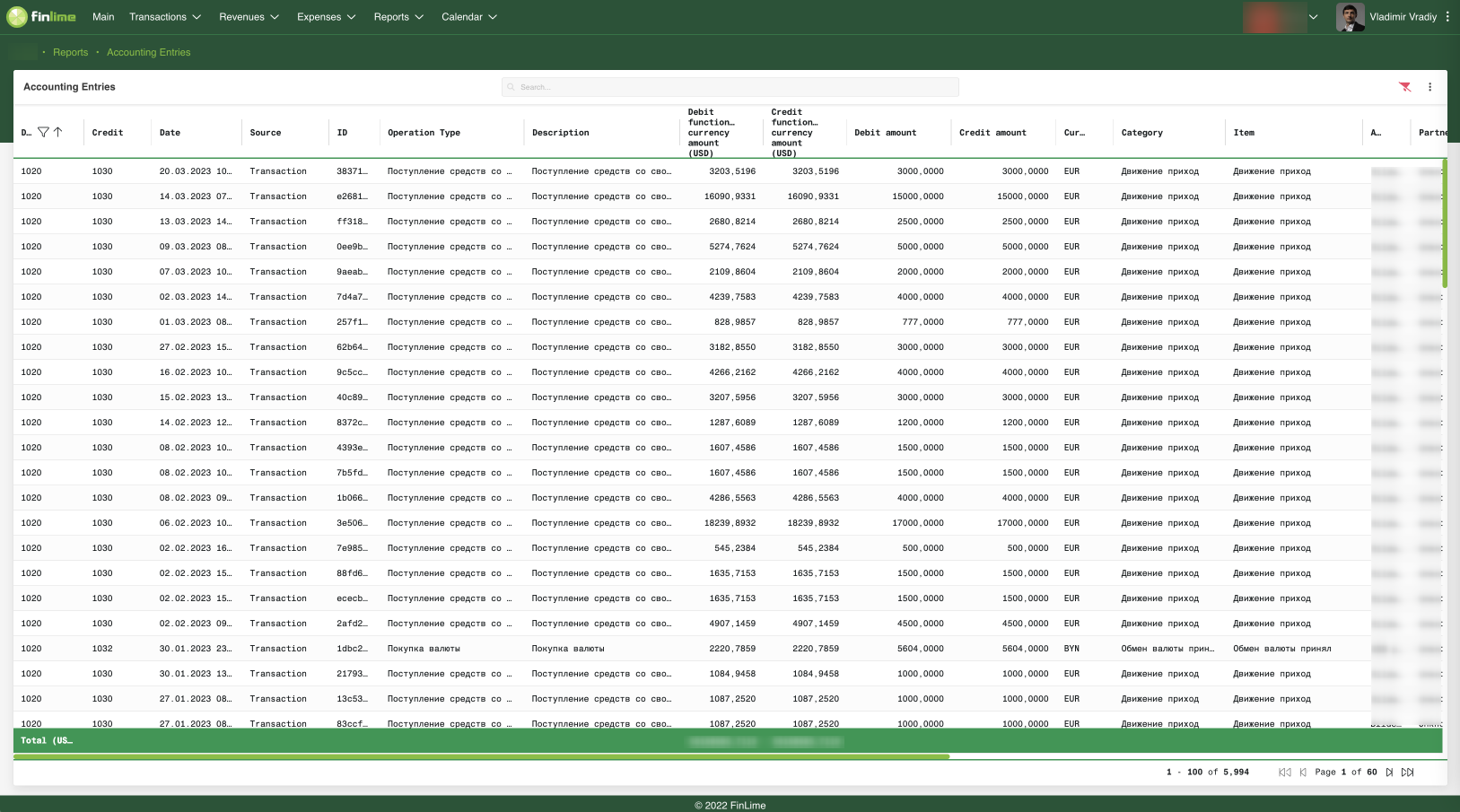

Accounting Entries are records that are used to keep track of all the financial transactions that take place in a company. Accounting Entries are the documentation that reflects each financial transaction such as selling goods or services, paying wages, taking a loan, etc.

Accounting records contain information about debits and credits, amounts, dates and other details of each financial transaction. These records are also displayed in accounting journals, general ledger and other financial statements such as balance sheet and income statement.

Accounting records play an important role in a company's financial accounting because they allow financial managers to track a company's income, expenses, and other financial transactions, and to assess its financial health and profitability. They are also used to prepare tax returns, reports to shareholders, and other financial statements.

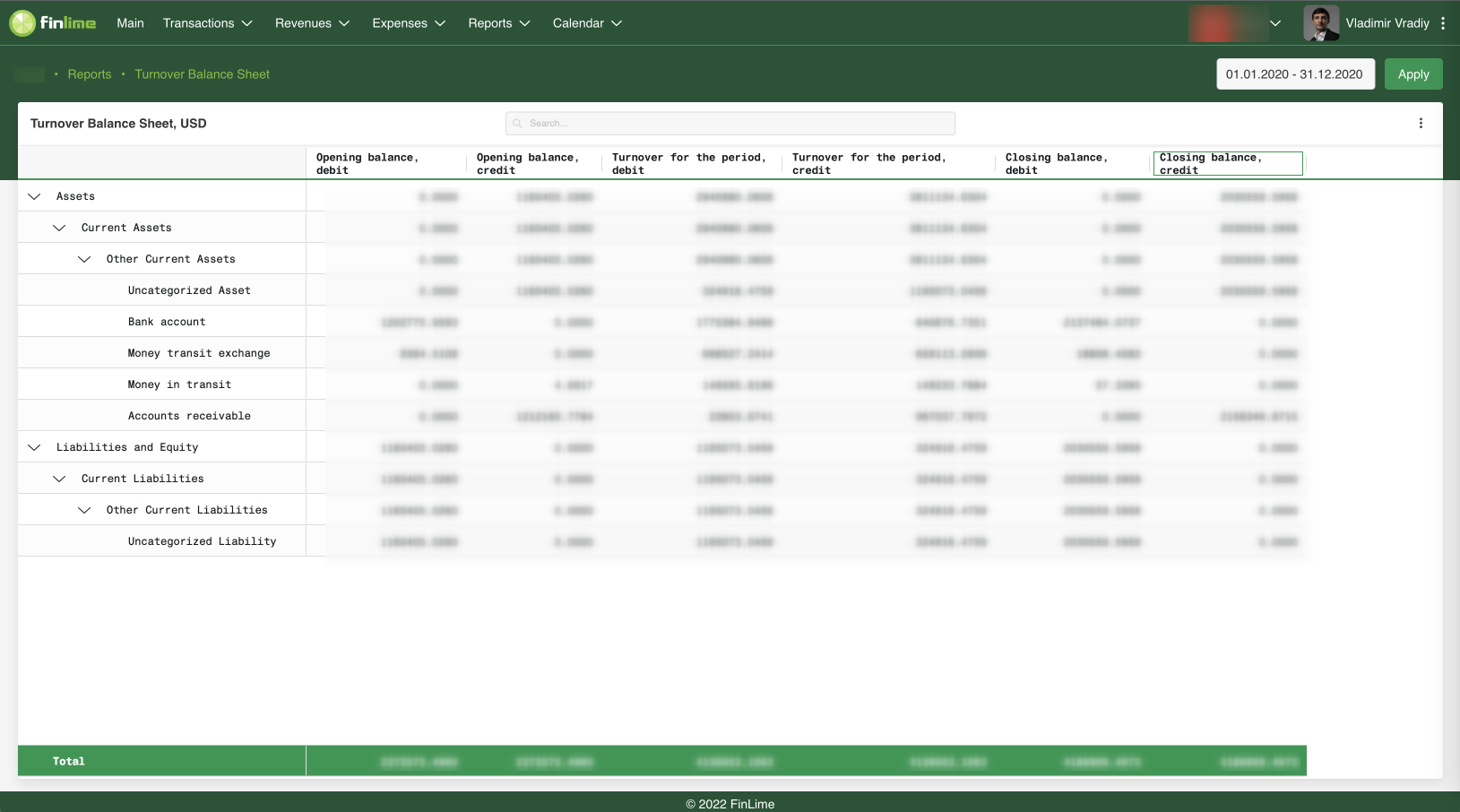

The Turnover Report is a financial report that shows changes in the company's turnover over a period of time.

The report shows the company's income and expenses, as well as changes in assets and liabilities for the reporting period.

A turnover report may also include an analysis of changes in the company's income and expenses by individual categories, such as goods, services, production costs, etc. It allows the financial manager to assess what changes have occurred in the company's financial performance over the reporting period and to identify the main factors affecting its turnover and profitability.

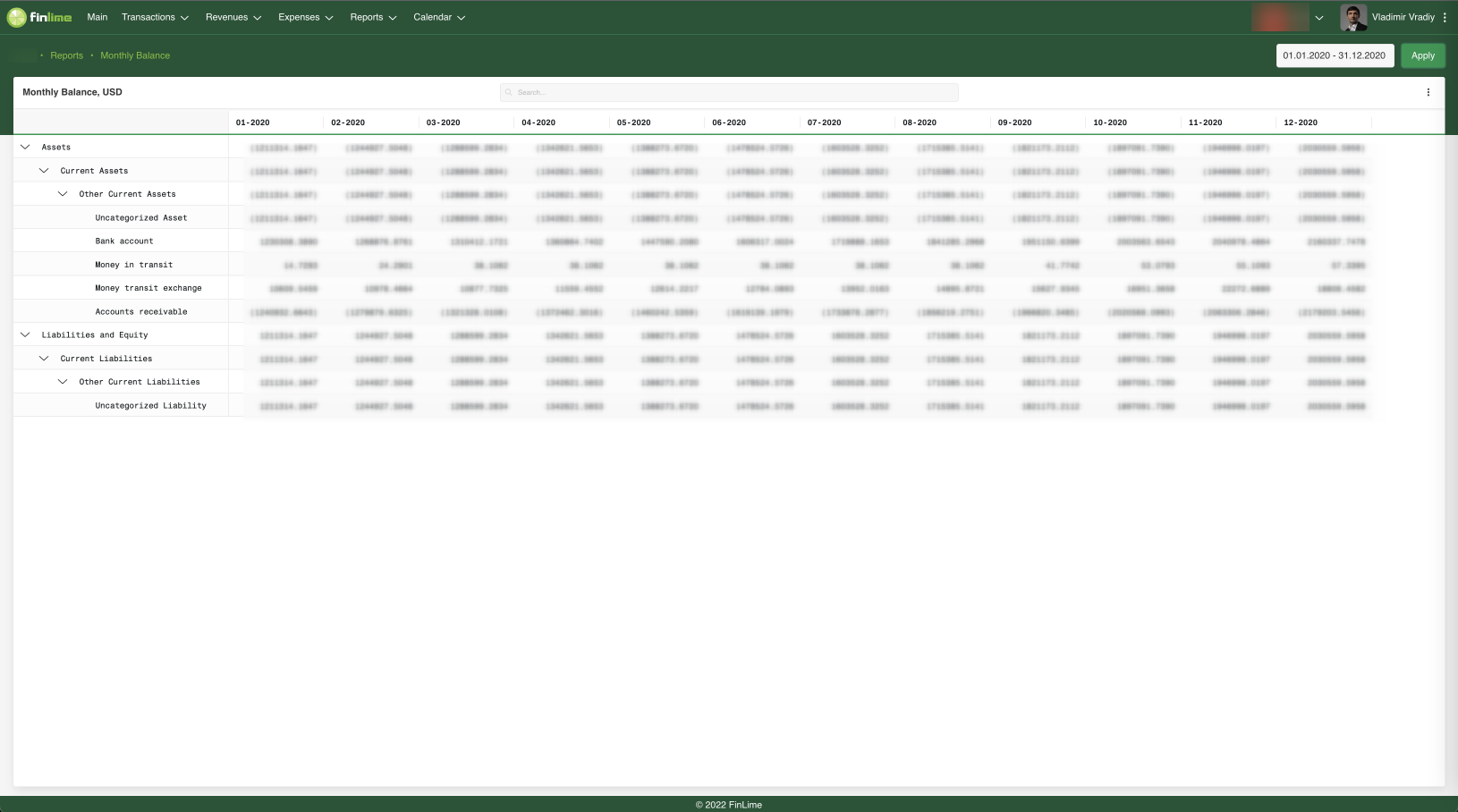

Monthly balance is a report that shows the financial condition of a company at the end of each month. The report shows the company's assets, liabilities and equity, as well as changes in their value over the previous month.

The monthly balance sheet report includes the following sections:

The monthly balance sheet report helps the financial manager assess what resources the company has at the beginning and end of the month, as well as what changes have occurred in the company's assets, liabilities, and equity during the reporting period. It can also be used to forecast a company's future financial condition and make informed financial decisions.

An income statement, also known as a Profit and Loss Statement (P&L), is a financial statement that shows a company's income and expenses for a specific period of time. The report allows you to evaluate a company's financial health, profitability and return on investment.

The report consists of three main sections: revenues, expenses and net profit (or loss). The income section reflects all the company's income for the reporting period, including sales of goods and services, lease payments, investment income, etc.

The expenses section reflects all expenses related to the company's core business, including costs of production and sale of goods and services, tax payments, lease payments, etc.

Net profit or loss is calculated as the difference between income and expenses. If revenues exceed expenses, the company makes a net profit, if expenses exceed revenues, the company experiences a loss.

The report is an important tool for a financial manager to analyse a company's financial performance and assess its profitability. It can also be used to forecast future revenues and expenses, determine the main factors affecting the company's profitability, and make informed financial decisions.

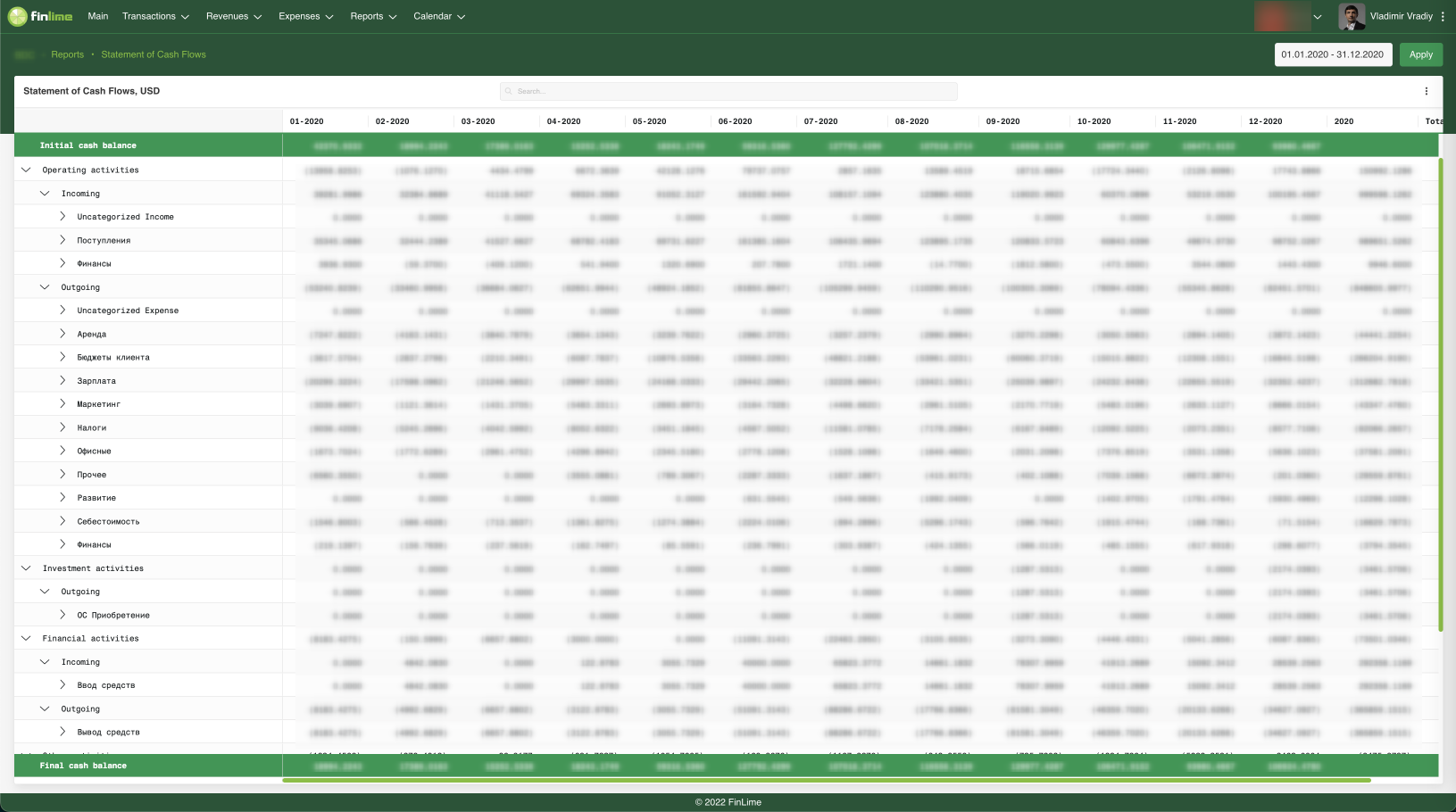

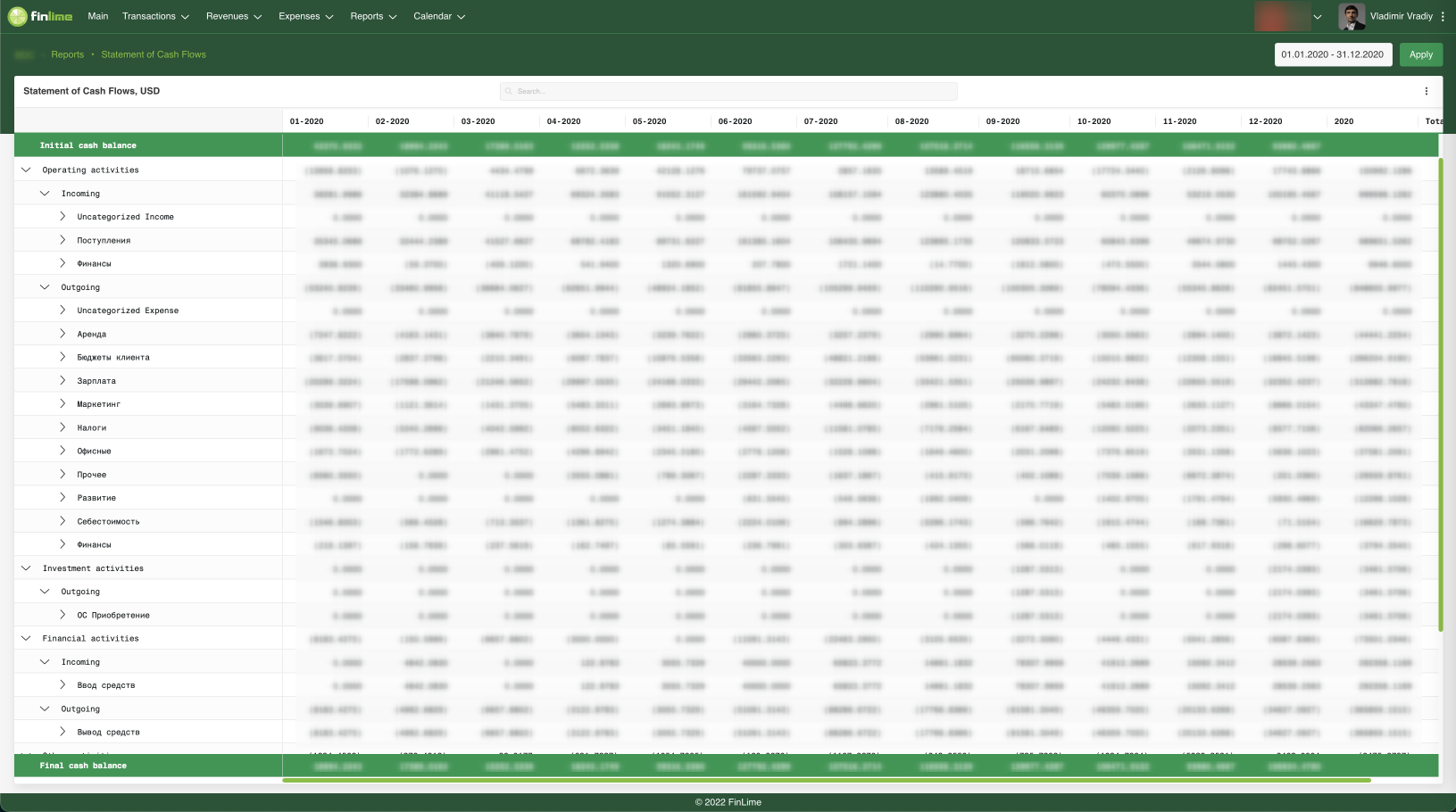

Cash Flows Statement is one of the main financial statements and shows the changes in the company's cash for the reporting period.

The report contains three main sections: operating activities, investing activities and financing activities. Each of these sections shows cash flows and their sources.

The operating activities section reflects receipts and expenditures related to the company's core business. For example, sales of goods or services, payroll payments, tax payments, etc.

The investment activities section shows receipts and expenditures related to the acquisition and sale of the company's assets. For example, purchase of new equipment, sale of existing assets or investments.

The financing activities section shows the receipts and expenditures related to debt and capital financing of the company. For example, paying dividends, taking out loans, or paying interest on existing loans.

The report allows the financial manager to assess the company's ability to generate cash, manage its liquidity and financial strength. The report can also be used to forecast future revenues and expenses, analyse financial results and make informed financial decisions.

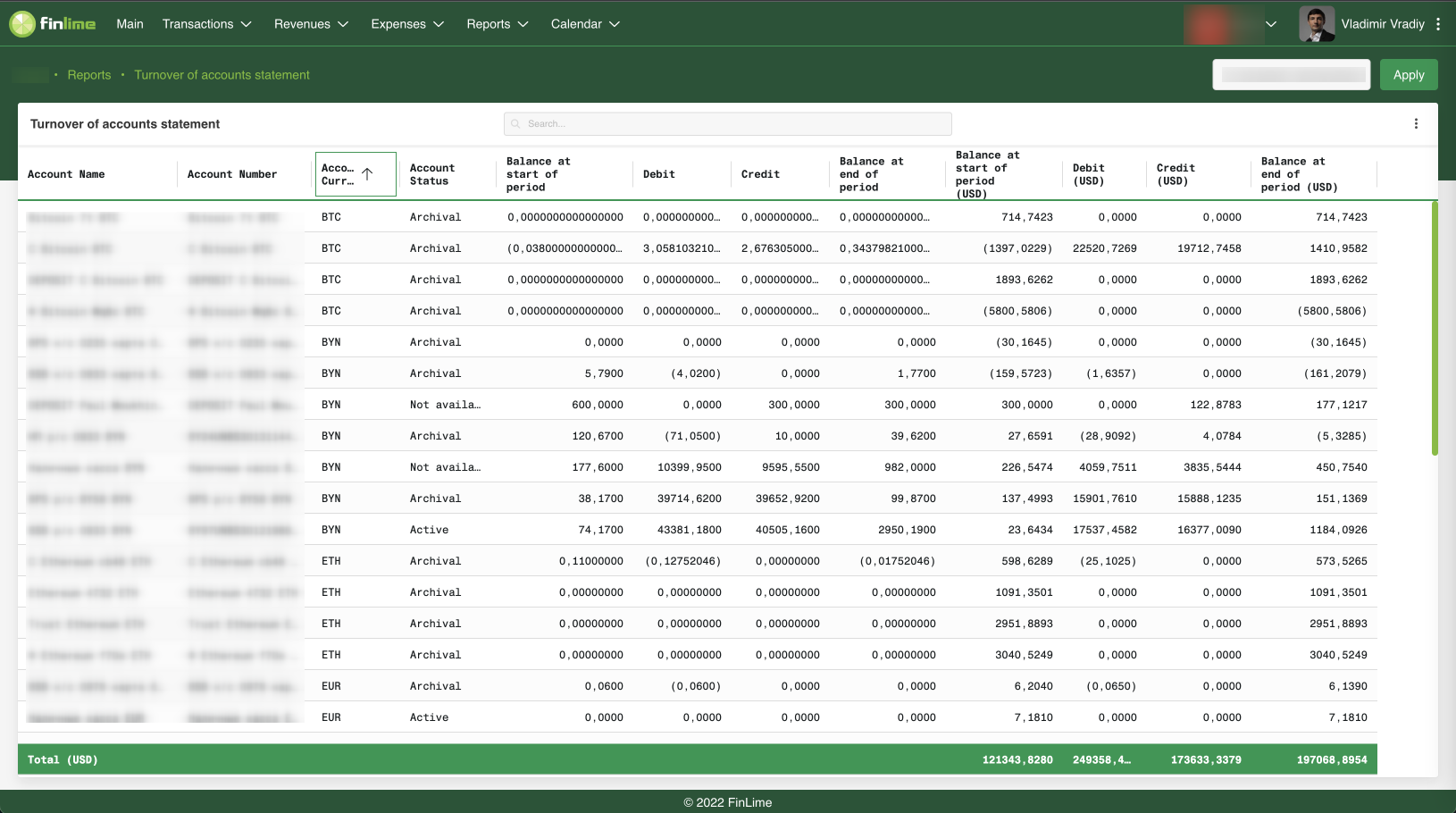

Turnover of accounts statement is a report that shows the cash flow in a particular bank account for a specific period of time.

The report contains information on cash receipts and disbursements to the account, including information on transaction dates, amounts, transaction descriptions and reasons for transactions. The account balance at the beginning and end of the period, as well as changes in the balance during the period, can also be indicated.

The report helps the financial manager monitor cash flow in a particular account and manage the company's liquidity. For example, it can be used to determine which transactions have increased or decreased the account balance, to forecast future receipts and expenditures, and to determine the causes of liquidity shortfalls.

The report can be useful for analysing a company's financial performance and for making financial decisions. It can be used in conjunction with other statements, such as the cash flow statement and the statement of financial performance, to get a complete picture of the company's financial health.

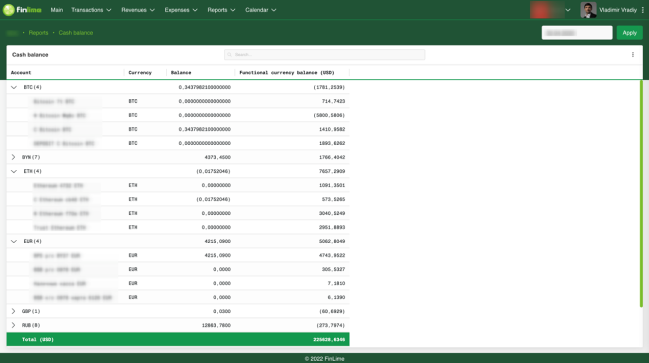

The Cash balance report is one of the important reports that provides information about the current cash balance in the company's bank accounts. It shows the available balance on all bank accounts, as well as information about planned receipts and expenditures in the near future.

This report allows the financial manager to quickly assess how much cash is available to pay current liabilities, as well as what measures need to be taken to ensure the necessary liquidity.

The report may also contain information about other accounts that may hold cash, such as cash on hand or electronic wallets.

For a more detailed analysis of the company's financial position, the report can be used in conjunction with other financial statements such as an income statement, cash flow statement, etc. This allows the financial manager to get a complete picture of the company's financial condition and make informed decisions.